Individuals and corporations alike can purchase tax credits to reduce federal and state tax liabilities and permanently lower their tax burdens—without participating in the activity related to the credit. However, determining which credits to purchase depends on the nuances of each individual or corporation and how they pay tax.

Below, gain insight into common federal tax credit investment opportunities available to you and your business and important factors to consider before purchasing a credit, including:

- How Do You Choose the Right Federal Tax Credit?

- What Should an Individual Taxpayer Consider When Investing in Federal Tax Credits?

- What Should a Corporate Taxpayer Consider When Investing in Federal Tax Credits?

- What Should a Financial Institution Consider When Investing in Federal Tax Credits?

- What Are Types of Tax Credit Investments?

- Are There Risks When Purchasing Federal Tax Credits?

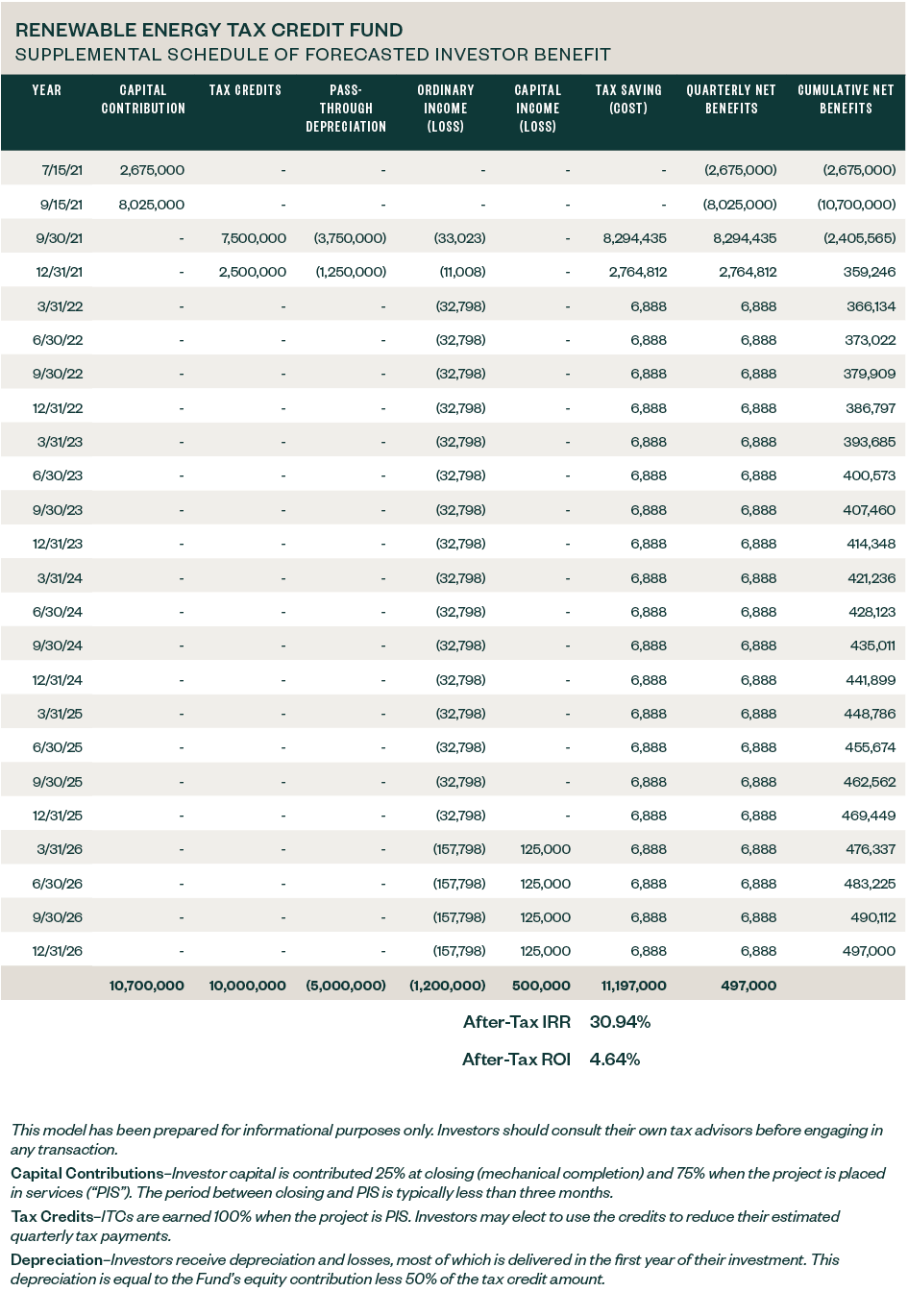

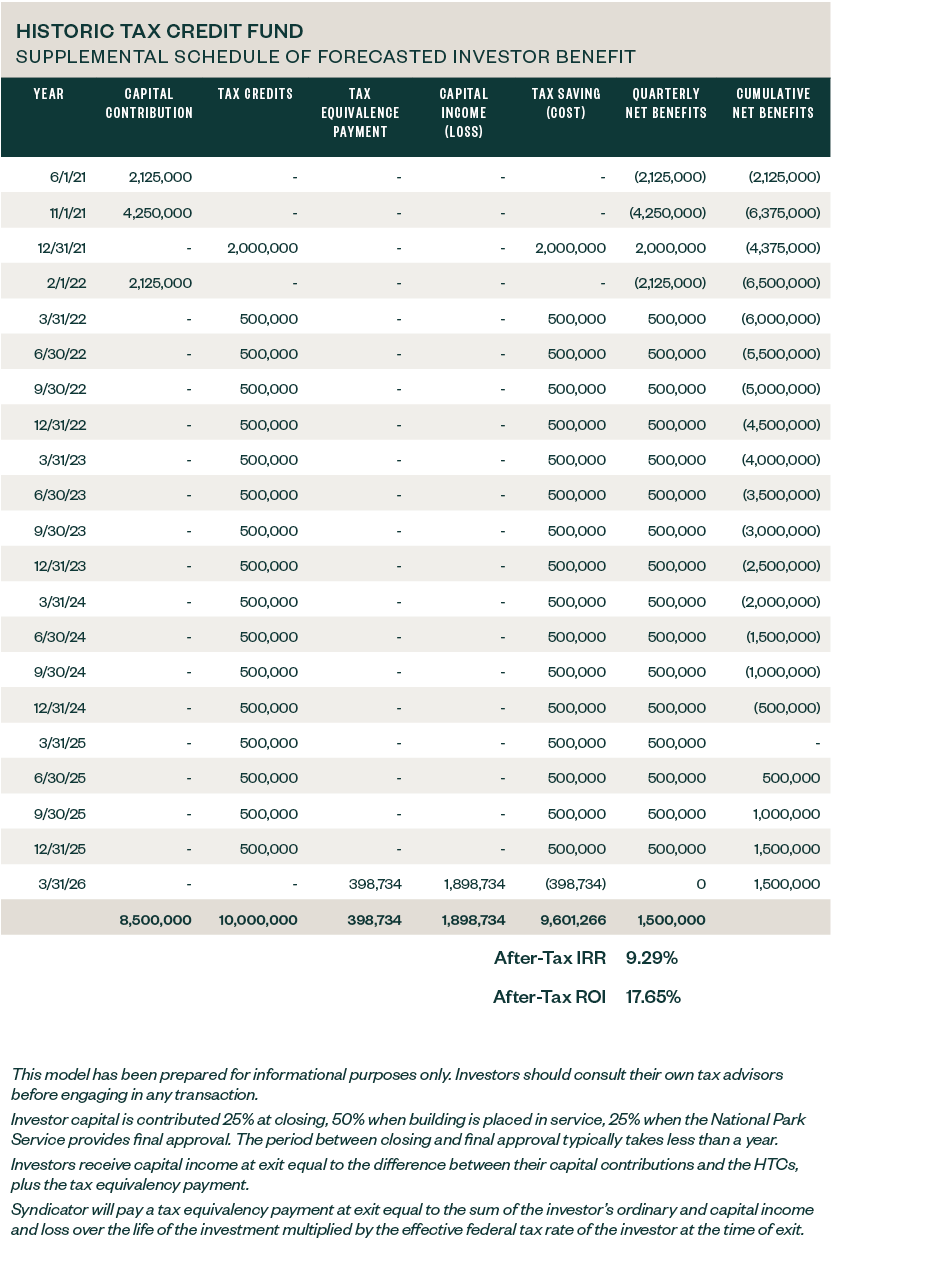

- How Do One- and Five-Year Returns Differ?

How Do You Choose the Right Federal Tax Credit?

Different credits benefit corporations, pass-through entities, and individuals—your personal circumstances will likely dictate which credits you should pursue.

Tax liability is also a major factor that dictates which credit makes the most sense for you. For example, you’ll benefit from different federal credits if your tax liability is predictable versus the result of a one-time event from a sale.

Timing is another consideration—some credits are delivered in one year versus over five, seven, or 10 years.

A step-by-step process for identifying which credit best fits your needs follows.

Step-by-Step Investment Identification Process

- Income. Identify the type of income a credit can offset based on whether you’re filing as a corporation or individual.

- Timing. Consider your timing—are you trying to offset just one year of tax liability or are you looking for a multiyear investment?

- Credit type. Determine which credit type best fits your needs.

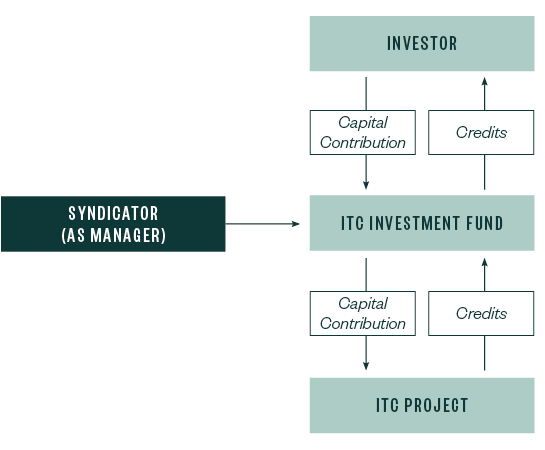

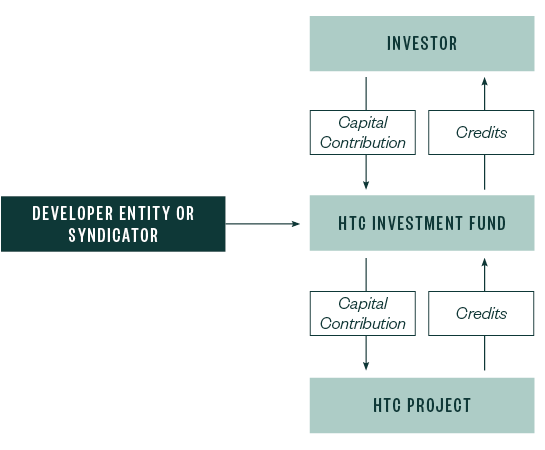

- Structure. Understand which investment structure best fits your needs. This might be based on whether you’ll have gain or loss at the end of your investment and whether you have an ability to monetize any loses.

- Tax implications. Understand other tax implications related to the investment, such as income, loss, and deprecation.

- Projects. Identify a project or syndicator with access to these credits.

- Due diligence. Conduct due diligence on the developer or sponsor, syndicator, and their contractor.

What Should an Individual Taxpayer Consider When Investing in Federal Tax Credits?

Purchasing tax credits as an individual is a little more complicated than purchasing as a corporation. You’ll need to be aware of some important tax considerations before getting started.

What Are Passive Activity Rules?

Passive activity rules are an important consideration for individual taxpayers; they determine how federal tax credits can be used.

The rules provide that credits can only be used to offset passive activity income—not active trade income, business income, W-2 wages or investment income, such as stock gains.

These rules may prevent some tax-credit investors from the ability to claim or utilize the credits. Investors aren’t actively involved in the underlying business activities generating credits and, as a result, they’re passive to the activity.

Accordingly, individual taxpayers can generally only participate in purchasing tax credits if they generate income from passive activities that can be offset by these credits.

What Are At-Risk Rules?

Another important consideration for individuals is the at-risk rules. At-risk rules intend to prevent the use of tax deductions or in this case tax credits to the extent the taxpayer has no real economic investment at risk.

As they relate to investment tax credits, the at-risk rules limit the use of the credit by reducing the base of investment tax credit property by the amount of any nonqualified nonrecourse financing.

These rules are important to individual taxpayers because the credits can be reduced, denied, or recaptured in later years should the at-risk tests not be met throughout the investment period.